Home : Joining NSDL : As a Broker

Joining NSDL as a Broker

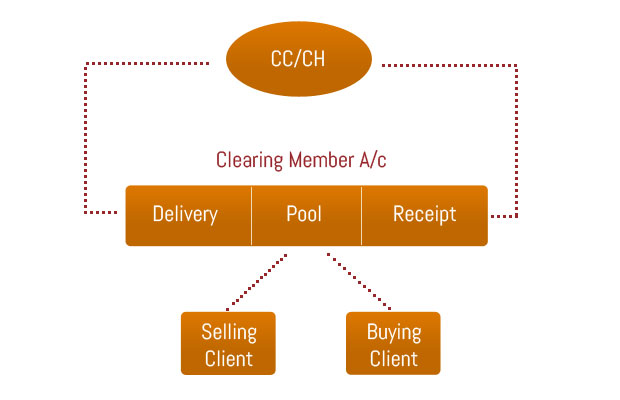

Members of the stock exchanges are an important link between investors and the clearing house in the depository system. Securities bought or sold are routed through the clearing member account for settlement in the depository system. Therefore, to settle trades in dematerialised securities, a stock exchange member must open a clearing account with any DP.

Therefore, to settle trades in dematerialised securities, a stock exchange member must open a clearing account with any DP.

Clearing member account : Member brokers of those stock exchanges which have established electronic connectivity with NSDL need to open a clearing member account, with a DP of his choice, to clear and settle trades in the demat form. This account is meant only to transfer shares to and receive shares from the clearing corporation/ house and hence, the member broker does not have any ownership (beneficiary) rights over the shares held in such an account.