Home : FAQ

FAQ

| 1. | What is a depository? |

| Answer | A depository can be compared to a bank. A depository holds securities (like shares, debentures, bonds, Government Securities, units etc.) of investors in electronic form. Besides holding securities, a depository also provides services related to transactions in securities. |

| 2. | How can I avail the service of a depository? |

| Answer | A depository interfaces with the investors through its agents called Depository Participants (DPs). If an investor wants to avail the services offered by the depository, the investor has to open an account with a DP. This is similar to opening an account with any branch of a bank in order to utilise the bank's services. Suggestions on how to select a DP are given in later part. |

| 3. | What are the benefits of participation in a depository? |

| Answer |

The benefits of participation in a depository are:

|

| 1. | What are the facilities offered by NSDL? |

| Answer |

NSDL offers following facilities

|

| 1. | How to Open a NSDL demat account? |

| Answer |

Opening a demat account is quite simple. All you have to do is to approach a NSDL DP, which will help you to complete the formalities. You need to fill up a form, submit PAN card and proof of address. In addition, you need to provide details of your bank account. Alternatively, you can click on https://nsdl.co.in/Open_NSDL_Demat_Account.php to open your demat account. After your demat account is opened, your DP will provide you DP ID and Client ID, a copy of your Client Master Report containing your demat account related details, tariff sheet and ‘Rights & Obligations of Beneficial Owner and Depository Participant’. DP ID is 8 characters long code, (example IN3XXXXX) allotted by NSDL to all DPs to identify them. Client ID is 8 digit long code used to identify the clients in the system. Combination of DP ID and Client ID makes your unique account number in the NSDL system. You should verify the Client Master Report to ensure that all your details have been recorded correctly in depository system. If you want to trade in shares etc. (i.e. buy or sell), you would also need to open a Trading / Broking account with any SEBI registered stockbroker. There are many DPs which offer 3-in-1 arrangement for the benefit of investors (3-in-1 is a combination of demat account, trading account and bank account). Now a days many NSDL DPs enable their clients to open demat account online, thus making the process paperless and extremely convenient. |

| 2. | How do I select a DP? |

| Answer |

You can select your DP to open a demat account just like you select a bank for opening a savings account. Some of the important factors for selection of a DP can be:

For list of DP locations, visit https://nsdl.co.in/dpsch.php and for their comparative charge structure, visit https://nsdl.co.in/about/charges.php |

| 3. | Whether all the DPs are same? |

| Answer |

NSDL has specified certain basic eligibility criteria for becoming a DP. The criteria are similar or even higher in certain respects than the corresponding provisions of SEBI regulations. All the DPs are same in the sense they are appointed by NSDL only after grant of Certificate of Registration by SEBI to them. However, the type of services offered, service standards and charges for the services rendered may differ among DPs. |

| 4. | What should I do if I want to open a demat account? |

| Answer |

Once you have decided to open an account with a particular DP, you may approach that DP and fill up an account opening form. You would be required to provide your photograph and self-attested copy of following documents -

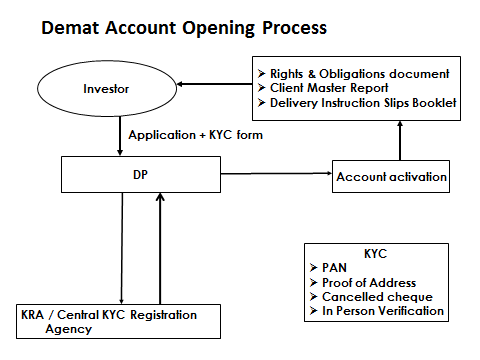

Please remember to take original documents to the DP for verification. In case you are unable to produce original document for verification, then photocopy should be attested by any authorized entity, like a public notary. Your DP may ask additional proof of identity / address to meet its requirements in addition to above-mentioned. The process of account opening is shown in the diagram below -

|

| 5. | What is in-person verification? |

| Answer |

It is mandatory to establish the identity of the applicant at the time of opening account as per SEBI guidelines. This is done by the DP’s staff by verifying the affixed photograph on account opening form and the photo seen on document on PAN card with the person seeking to open the account. For Joint account holders, the ’in-person verification’ is required for all the holders. |

| 6. | Can I open more than one demat account? |

| Answer |

Yes. You can open more than one account with the same DP. There is no restriction on the number of accounts you can open with a DP. |

| 7. | Do I have to keep any minimum balance of securities in my demat account? |

| Answer |

No. The depository has not prescribed any minimum balance. You can have zero balance in your demat account. |

| 8. | Why should I give my bank account details at the time of account opening? |

| Answer |

Providing bank account details at the time of demat account opening is mandatory. These bank details are communicated to issuer companies / RTAs for the purpose of crediting any amount payable to you (such as dividend, interest or maturity payment or redemption amount) directly in your bank account. It is therefore suggested that you provide details of your active bank account in the account opening form. Later, in case of change therein, please remember to inform to your DP. |

| 9. | What is 'Standing Instruction' given in the account opening form? |

| Answer |

In demat account, debit or credit transactions are permitted only if it is duly authorized by the respective holder(s). As a Delivery Instruction Slip (DIS) is required for every debit transfer in the demat account, a 'Receipt Instruction Slip' is required for every credit transfer in the demat account. By giving a onetime standing instruction to your DP, you may avoid giving receipt instruction to your DP whenever a credit is expected in the account. |

| 10. | Can I operate a joint account on "either or survivor" basis just like a bank account? |

| Answer |

No. As per rules applicable at present, demat account cannot be operated on 'either or survivor' basis like the bank account. Therefore, every instruction given for a jointly held demat account needs to be signed by all the joint holders. |

| 11. | Can I transfer all my securities to my account with another DP and close my demat account with one DP? |

| Answer |

Yes. In case you have multiple demat accounts with one or more DPs and do not wish to continue with them, you may submit account closure form to your DP(s) in prescribed format. In the form, you are required to mention DP ID, DP name and Client ID of the account where you wish the balances to be transferred. Your DP will transfer all your securities as per your instruction and close your demat account. It is important to understand that a demat account cannot be closed if there is any balance in the account. |

| 12. | What can I do with my NSDL demat account? |

| Answer |

There are numerous uses of your NSDL demat account. Few important things that you can do with your NSDL demat account are listed below – You may apply for IPOs and NFOs. Do not forget to mention your DP ID and Client ID correctly in the application form. Same demat account can be used to purchase and hold shares and other types of securities. You will automatically receive all corporate benefits (bonus, rights issue, etc.) in your demat account. Cash benefits like dividend declared by your company, interest or maturity amount payable on your bond investments etc. would be credited to bank account linked with your demat account. Please ensure correct bank account details are recorded in your demat account. You may use your demat account to avail 'loan against shares' facility which is offered by many banks etc. to meet your financial requirements without requiring to sell the investments. You may convert all your investments in shares, bonds, debentures, government securities, sovereign gold bonds etc. held in paper form to demat form through your DP. You may hold your mutual fund investments in the same demat account. Holding mutual fund units in demat account makes things a lot easier for you. You would be able to monitor your portfolio at one place through NSDL CAS. It also saves you from the need to engage with various mutual fund houses if you want to make any change in your personal information, for example, address or bank details or nominee, etc. You may subscribe to mutual fund units in demat form by simply mentioning your DP ID and Client ID in application form. Investment in mutual funds by way of SIP is also possible through your demat account. For redemption or repurchase of mutual fund units, you may give an instruction to your DP or may use NSDL's SPEED-e facility. You may participate in buyback offer by tendering your shares to company through your demat account. You may participate in securities lending and borrowing scheme by lending securities lying idle in your demat account and may earn market returns. |

| 13. | How can I shift or transfer my demat account from one DP to another DP? |

| Answer |

For shifting or transfer of a demat account, you need to first open a new demat account where you want the balances to be transferred to (if you already have another demat account, then you may use it for this purpose, instead of opening a new account). Then you need to submit duly filled and signed ‘Account Closure Form’ to your existing DP. In the form, you should mention the details of the other demat account where you want the balances to be transferred. After verification of your request, your DP will arrange to transfer the balances to the desired account and then close the source account. |

| 1. | What is dematerialization? |

| Answer |

Dematerialization is the process by which physical certificates of securities are converted into securities in electronic form by way of credit in investor's demat account held with a DP. Dematerialization is change in form of holding, it does not result into change of ownership. |

| 2. | How can I dematerialize my securities certificates? |

| Answer |

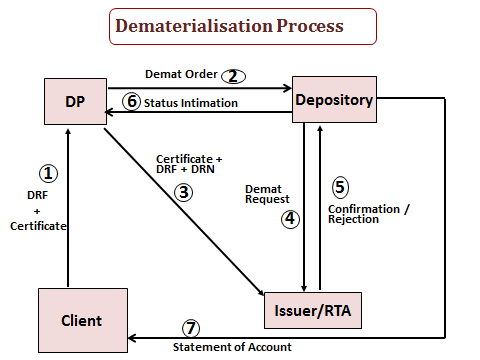

In order to dematerialize certificates, you need to open a demat account. Once the demat account has been opened, you need to fill up a 'Dematerialization Request Form' in prescribed form and submit it to your DP along with the security certificates. Your DP will forward the demat request to the concerned issuer company or its Registrar and Transfer Agent for further processing. Once the request is confirmed by the concerned issuer company or its Registrar and Transfer Agent, it results in credit of electronic securities in the demat account of the respective investor. The process of dematerialization is shown in the diagram below –

|

| 3. | Can I dematerialize any share certificate? |

| Answer |

No, not all the share certificates can be dematerialized. For dematerialization, following conditions should be met with -

Most of listed and active companies have already joined NSDL and their shares and other types of securities are available for demat. Many other companies are in the process of joining NSDL. You may search if the shares held by you are available for demat or not, at https://nsdl.co.in/master_search.php. |

| 3. | What precautions should I take before submitting my certificates to DP for dematerialization? |

| Answer |

You should take care of following -

After above steps, you may mark the share certificates that you wish to dematerialize with words 'Surrendered for Dematerialisation'. Your DP will provide you the rubber stamp to be used for this purpose. |

| 4. | How long does the dematerialization process take? |

| Answer |

As per SEBI's guidelines, DP is required to process the demat request received by it within 7 days. Further, issuer company / its RTA may take up to 15 days to process the demat request received by them. Considering the time required for transmission of documents from DP to issuer company / RTA, dematerialization will normally take about 30 days. |

| 5. | Can I open a single account to dematerialize securities owned individually and securities owned jointly along-with my wife? |

| Answer |

No. The demat account must be opened in the same ownership pattern in which the securities are held in the physical form. For example, if one share certificate is in your name and another certificate has your name along with your wife's name, then you would need to open two demat accounts (one in your name and other in joint names of yourself and your wife). |

| 6. | Do I have to dematerialize securities that I do not intend to sell? |

| Answer |

The Depositories Act, 1996 gives investors an option to hold securities in physical form or demat form. Hence, if you do not intend to sell the securities, you may not dematerialize them. However, holding the securities in demat form entails numerous benefits and is therefore highly recommended. Further, there are existing / proposed restrictions on transfer of securities belonging to listed companies and unlisted public limited companies, if held in physical form. It may therefore be better to dematerialize the securities. |

| 7. | Can I dematerialize my investment in tax-free bonds which are under lock-in? |

| Answer |

Yes. You can dematerialize your tax-free bonds even when they are under lock-in. The process of demat is similar to that applicable to demat of shares. You need to submit duly filled in and signed DRF to your DP along with bond certificates. DP will forward the request to concerned issuer / its RTA and upon confirmation, credit will be received in your demat account. |

| 8. | Can I purchase government securities directly in demat form? |

| Answer |

Yes. Now the market of government securities like bonds and Treasury Bills (T-Bills) is easily accessible to retail investors. In fact, RBI does keep a portion of new issues reserved for retail investors. You may invest in G-Sec by participating in auction of new securities or by purchasing already issued securities in secondary market. For both, you need to approach any authorized bank or primary dealer or stock broker, mentioning your demat accounts details (DP ID and Client ID). |

| 9. | How can I subscribe to Sovereign Gold Bonds (SGB) in demat form? |

| Answer |

The SGB offers a superior alternative to holding gold in physical form. Option to hold SGB in demat form makes it even better and convenient. The process to buy or subscribe to sovereign gold bonds in demat form is quite easy. All you need to do is to mention your DP ID and Client ID in your subscription form. Some banks offer online application facility also (if investor makes application online and does payment electronically, then some price discount is also available at present). Upon allotment by RBI, your demat account will credited with the requisite number of bonds. |

| 10 | Can I convert my investment in Sovereign Gold Bonds (SGB) held in paper form (Certificate of Holding form) into demat form? |

| Answer |

Yes, you may do so. For this purpose, you need to contact the bank / agent from whom you had purchased the SGBs. They will assist you in conversion of SGBs held in form of Certificate of Holdings into demat form. |

| 11. | Can I convert my investment in government securities held in SGL form to my demat account kept with NSDL DP? |

| Answer | Yes. You need to provide a duly filled in and signed request in prescribed format (known as Dematerialization Request Form - Government Securities) along with 'Form of Transfer' to your DP. Your DP will forward the request to NSDL. NSDL will arrange for necessary credit in your demat account. |

| 12. | I have physical certificates with the same combination of names, but the sequence of names is different. In some certificates, I am the first holder and my wife is the second holder, whereas in some other certificates, my wife is the first holder and I am the second holder. Do I need to open two different accounts for the purpose of dematerialization of these certificates? |

| Answer |

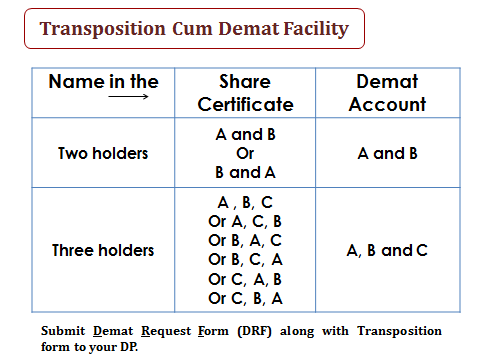

The joint holders are entitled to change the sequence of names by making a written request to the company. This does not constitute a transfer. Changing the sequence of joint holders is called 'Transposition'. However, transposition facility can be availed for entire holdings in a folio and not allowed for part of the holdings. If the same set of joint holders hold securities in different sequence of names, then there is no need to open multiple demat accounts for dematerialization of such securities. Using 'Transposition cum Demat facility' such securities held vide certificates in different combinations, can be dematerialized in one demat account. For this purpose, Dematerialization Request Form (DRF) and an additional form called 'Transposition cum Demat Form' should be submitted to the DP. This is explained in the diagram below -

|

| 1. | Can my electronic holdings be converted back into paper certificates? |

| Answer |

Yes. If you wish to get back your securities in physical form, you need to submit 'Rematerialisation Request Form' in prescribed format to your DP. After necessary checks, your DP will forward your request through NSDL's depository system to the concerned Issuer company / RTA. The company / RTA will print the certificates and dispatch the same to you directly. You should check the rematerialisation charges with your DP before submitting the request. |

| 1. | What is the meaning of ‘Nomination’? |

| Answer |

Nomination is a simple process by which a holder of securities communicates his / her preference regarding who should receive these securities in case of his / her death. Process of nomination in respect of demat account can be done at the time of opening of demat account or any time later. |

| 2. | Who can nominate? |

| Answer |

Nomination can be made only by individuals holding demat account singly or jointly. Non-individual holders like society, trust, body corporate, partnership firm , Hindu Undivided Family and holder of Power of Attorney cannot nominate. |

| 3. | Can joint holders nominate? |

| Answer |

Yes. Nomination is permitted for accounts with joint holders. However, in case of death of any of the joint holder(s), the securities will be transmitted to the surviving holder(s). Only in the event of death of all the joint holders, the securities will be transmitted to the nominee (if nomination given, else to legal heir). |

| 4. | Can a NRI nominate? |

| Answer |

Yes, NRI can nominate directly. However, the power of attorney holder cannot nominate on behalf of NRI. |

| 5. | Can a minor nominate? |

| Answer |

No. Minor cannot nominate either directly or through his / her guardian. |

| 6. | Who can be a nominee? |

| Answer |

Only an individual can be a nominee. Non individuals like society, trust, body corporate, partnership firm, Hindu Undivided Family cannot be a nominee in the demat account. |

| 7. | Can there be more than one nominee? |

| Answer |

Yes, at present up to three nominations can be made for one demat account. In case, two or three nominees are mentioned, then it is also required to mention the proportion (%) in which various securities are desired to be transmitted upon death of the account holder. |

| 8. | Can a minor be a nominee? |

| Answer |

Yes, a minor can be a nominee. Whenever, a minor is mentioned as a nominee in a demat account, details of his / her guardian should also be mentioned. |

| 9. | Can separate nomination be made for each security held in a demat account? |

| Answer |

No. Nomination can be made account wise and not security wise. This means, in case of death of account holder, all the securities lying in the demat account, are liable to be transmitted to nominee(s) in the pre-registered proportion. If you wish different nominees for different securities, then you may consider keeping the securities in different demat accounts and mention nominee(s) as per your choice. |

| 10. | Can a NRI be a nominee? |

| Answer |

Yes, NRI can be a nominee in a demat account subject to the provision of foreign exchange regulations in force. |

| 11. | What is the procedure for appointing a nominee? |

| Answer |

The demat account holders need to mention the information related to nominee(s) in the account opening form at the time of account opening. Up to three different individuals may be mentioned as nominee in one demat account. |

| 12. | Can the nominee be changed? |

| Answer |

Yes, the nomination can be changed anytime by the account holder(s) by simply filling up the Nomination form once again and submitting it to the DP. |

| 13. | Is it necessary to have nominee in the demat account? |

| Answer |

Nomination is not mandatory for demat account. However, it is very much recommended to have nominee mentioned in the demat account. In the unfortunate case of death of sole account holder, it makes the process of transmission very easy and fast. In you do not wish to mention any nominee at the time of account opening, you are required to state that ''I/We do not wish to make a nomination''. |

| 1. | What does transmission mean in relation to demat accounts? |

| Answer |

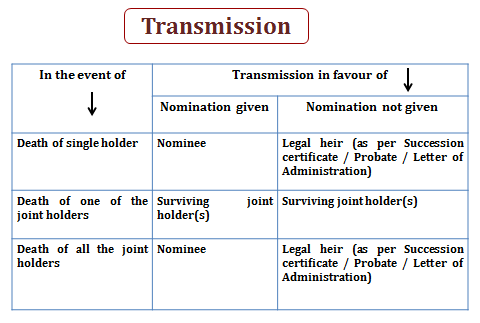

Transmission is the process of law by which securities belonging to a deceased account holder are transferred to surviving joint holder(s) / legal heirs / nominee of the deceased account holder. Process of transmission in case of dematerialized holdings is relatively convenient as the transmission formalities for all securities held in a demat account can be completed by submitting the requisite documents to DP. There is no need to approach various companies for this purpose, as is required when securities are held in physical form.

|

| 2. | What is the procedure for transmission of securities to the nominee in case of the death of the sole account holder? |

| Answer |

In case of the death of the sole holder, for transmission of securities, the nominee needs to submit duly filled-in transmission form along with a copy of the death certificate duly attested by a Notary Public or a Gazetted Officer. In case the account of the claimant is not with the same Participant, copy of Client Master Report of the account of the claimant (certified by the concerned DP) is also required. After verification of these documents, the DP will transmit the securities to the demat account of the nominee. |

| 3. | What would happen if there is no nominee in the demat account held by sole holder? |

| Answer |

In such a case, the securities would be transmitted to the account of legal heir(s), as may be determined by an order of the competent court. Following documents are required for this purpose -

However, if the value of securities to be transmitted is below ₹5,00,000/- (on the day of application for transmission), the DP may process the request based on following documents:

|

| 4. | What is the procedure for transmission in case of death of one or more joint holder(s)? |

| Answer |

In such a case, the securities would be transmitted to the surviving holder(s), irrespective of the nomination. For example, if the account is in the joint names of Mr. A, Mr. B and Mrs. C, in the event of the death of Mr. B, the securities will be transmitted to surviving holders that is, Mr. A and Mrs. C. The surviving holder(s) would need to submit the following documents to the DP:

|

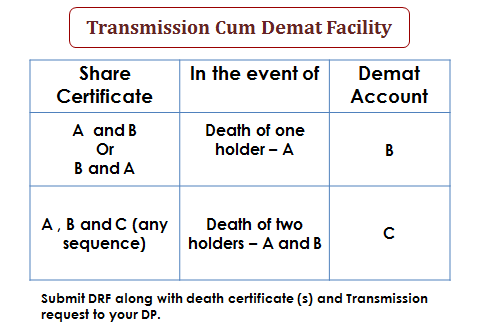

| 5. | What is the meaning of 'Transmission cum Demat'? |

| Answer |

'Transmission cum Demat' is a very useful facility when one of the joint holders mentioned in securities certificate (held in physical form) has died and remaining holder(s) wish to have the securities transmitted in their name in demat form. Using this facility the twin objectives of deletion of name of one of the deceased joint holders and dematerialization of securities can be achieved in a single step. This is explained in the diagram

|

| 1. | What is the procedure for selling dematerialized securities? |

| Answer |

The procedure for selling dematerialized securities is very simple, as given below -

|

| 2. | How can I buy securities in demat form? |

| Answer |

The procedure for buying securities in demat form is very simple, as given below -

|

| 3. | What are 'Market Trades' and 'Off Market Trades'? |

| Answer |

Any trade settled through a clearing corporation is termed as a 'Market Trade'. These trades are done through stockbrokers on the platform of a recognized stock exchange. An 'Off Market Trade' is one which is settled directly between the two parties, without the involvement of clearing corporation. |

| 4. | What is 'Inter Depository transfer'? Is it possible to transfer any ISIN to other depository? |

| Answer |

Transfer of securities from a demat account held with one depository to another demat account held with a different depository is known as 'Inter Depository Transfer' (IDT). IDT is possible for those ISINs which are active in both the depositories. |

| 5. | What is partial account transfer? |

| Answer |

In case you give a pay-in instruction for quantity which is more than the quantity available in demat account at the time of settlement of the instruction, then your demat account is debited to extent of balance available. In case of off market transfer, if sufficient balance is not available then the entire instruction fails, meaning that debit does not take place. |

| 6. | What is meant by market type and settlement number? |

| Answer |

On every stock exchange, various transactions happen under different trade windows. These windows are identified by a distinct combination of a market type and a settlement number. It is important that you mention correct market type and settlement number (together said to be settlement details in depository system) in the delivery instruction slip so that your pay-in obligations are settled correctly. These details can be found in the contract note issued by the broker. |

| 7. | What is T+2 rolling settlement cycle? |

| Answer |

Under T+2 rolling settlement system, trades (buy and sell) happening on the platform of stock exchange on day 1 (T) are settled by the concerned clearing corporation two days later, means on the day 3 (T+2). For example, trades undertaken on Monday will be settled on Wednesday (presuming all days are working days). Similarly, all trades undertaken on Tuesday are settled on Thursday, so on and so forth. This kind of settlement system is known as T+2 rolling settlement. |

| 8. | In case of T+2 rolling settlement cycle, if I have sold shares through my broker / authorized person on Monday, when do I need to give delivery instruction to my DP? |

| Answer |

As the trade has happened on Monday, pay-in of securities will take place on Wednesday, meaning your broker must get the securities before the clearing corporation prescribed time on Wednesday. As your DP will need some time to process the delivery instruction slip given by you, it would have prescribed some timeline for submission of pay-in related instructions (typically previous day of pay-in day). You need to ensure that your delivery instruction slip reaches your DP well before the given time and day. It may therefore be better to submit your delivery instruction slip to your DP immediately once you receive confirmation of your sell order from your broker. |

| 9. | How do I come to know about the deadlines for submission of instruction slips for pay-in? |

| Answer |

Your DP will prescribe the timelines to be followed by you for submission of delivery instruction slips and communicate to you. These are generally printed on the DIS booklet given by the DP also for your information. |

| 10. | When I buy shares, by what time should I receive the securities from my broker? |

| Answer |

The broker is required to transfer the securities to you within one working day, after securities are received in its clearing member account, provided you have made the requisite payment to the broker. |

| 11. | What is the meaning of acceptance of instruction slip on 'At client's risk' basis by DP and what is its significance? |

| Answer |

Every DP prescribes some timelines for submission of delivery instruction slips. If it happens that your instruction slip reaches your DP after such deadline time, your DP can accept it with limited liability for its execution in the depository system. In such cases, DPs do mark the instruction slip (client copy as well as their office copy) with stamp containing description similar to 'Received late, Subject to best efforts' or 'Late, received at Client's risk'. If for some reason, DP is unable to execute the late received instruction in depository system successfully, and this results into client failing to meet its pay-in obligation, leading to financial loss (auction charges etc.), DP cannot be held liable for such loss. |

| 12. | What precautions do I need to observe with respect to Delivery Instruction Slips? |

| Answer |

Delivery Instruction Slips are similar to your bank account cheque book. You should take care of following points in respect of DIS -

|

| 13. | What is 'execution date' given in the delivery instruction slip? |

| Answer |

Execution date is the date on which securities will be actually debited from your account. In order to ensure that the instruction gets executed on the execution date written on the delivery instruction slip, it must be entered by DP in the depository system. You may issue the instruction well in advance of the date on which you want the securities to be debited from your account (your account will be debited only on the execution date mentioned in DIS). |

| 14. | What benefit do I get by giving delivery instruction with a future execution date? |

| Answer |

By giving a future dated instruction the risk of non-execution of instruction due to lack of time or last minute rush is avoided. You may like to use this facility to ensure that shares etc. are transferred to intended beneficiary's account on a day of your choice. |

| 15. | What is meant by 'Reason / Purpose' and 'Consideration' in respect of off market transfers? |

| Answer |

As per SEBI's guidelines, the reason or purpose for which the off market transfer is undertaken and consideration for such transfer, needs to be mentioned on the delivery instruction slip submitted for such transfer. There are various options given in the DIS booklet for 'Reason / Purpose'. You need to select the appropriate one and mention it on the DIS. If the Reason / Purpose of the transfer is 'off market sale' then in addition to amount of consideration, you need to mention the following details also -

|

| 1. | What is the meaning of pledging of shares? |

| Answer |

Pledging is basically committing the shares held by a person (pledgor) in favour of another person (pledgee) as a security or collateral for the exposure granted by pledgee. Generally, shares are pledged by the concerned shareholder for taking loan against shares. |

| 2. | What should I do if I want to pledge shares held in my demat account for availing loan against securities facility offered by my bank? |

| Answer |

The procedure is as follows:

|

| 3. | What is the effect of creation of pledge on the securities? |

| Answer | Once the pledge instruction is confirmed in depository system, the underlying securities are blocked in the demat account of pledgor. Until this block remains, pledgor is disabled from disposing of those securities. |

| 4. | After repayment of the loan taken, how should I get back my pledge securities as free balance in my demat account? |

| Answer |

Upon repayment of loan, pledgor should submit a duly filled in ‘Pledge Closure Initiation Slip’ to its DP. Once executed, the information is forwarded to DP of the pledgee. The pledgee then may submit ‘Pledge Closure Confirmation Instruction’ to its DP. (Alternatively, the pledgee may give instruction to its DP to close the pledge without waiting for request from the pledgor). |

| 5. | Can I change the securities offered in a pledge? |

| Answer |

Yes, if the pledgee (lender) agrees, you may change the securities offered in a pledge. For this purpose, a new request for creation of pledge will have to be given by the pledgor and the existing pledge needs to be closed. |

| 6. | Who will receive dividend on the pledged securities? |

| Answer |

The pledgor continues to be the beneficial owner of the underlying securities during the period of pledge. Therefore, all the corporate benefits declared by the company during this period belong to pledgor. The pledgee will get the benefits if pledge is invoked and on record date, the shares remain in pledgee’s account. |

| 7. | How will the distribution of bonus shares for pledged shares happen? |

| Answer |

If the shares are in pledged status on the record date, bonus shares are credited to pledgor’s account with pledge marked in favour of the pledgee. Later when the pledge is closed, all the shares (including the bonus) will be credited to the pledgor’s account as free balances. In case of invocation of pledge, all the shares (including the bonus) will be moved to pledgee’s account. |

| 8. | What is Digital LAS facility? |

| Answer |

Digital LAS (Loan Against Shares) is a facility enabled by NSDL for making the process of loan against shares online. Using this facility, a demat account holder can obtain finance (loan) against pledge of eligible securities held in demat account in favour of lending bank. For more information on this, you may check with a participating bank. |

| 9. | What is the difference between Pledge and Hypothecation? |

| Answer |

In depository system, there is no difference between pledge and hypothecation except that pledge can be invoked by the lender (pledgee). Whereas, in case of hypothecation, for invocation to take place, consent of borrower (hypothecator) is also required. |

| 1. | Does a pledgee bank needs a separate depository account for each branch (for pledging)? |

| Answer |

Both pledgor and pledgee must have a beneficial owner account in NSDL. A pledgee bank can either operate through a single account for all its branches or open a separate account for each branch (with the same DP or with different DPs.) |

| 2. | If a pledgee is also a DP, can it open multiple house accounts. i.e. one house account per branch? |

| Answer |

Yes, the pledgee can open multiple house accounts i.e. one house account for every branch. |

| 3. | What is the procedure for pledging securities in NSDL? |

| Answer |

The procedure for pledging in NSDL is explained below:

|

| 4. | What precaution should be taken before disbursing loan to the pledgor? |

| Answer |

The pledgee may disburse the loan only after the pledgee’s DP confirms the creation of pledge. Pledge does not get created in the system until the pledgee’s DP confirms the pledge. Pledgee may obtain pledge report from its DP and verify creation of pledge. |

| 5. | After the loan is repaid, how is the pledge closed in the depository system? |

| Answer |

After the loan is repaid, the pledgor will instruct its DP to close the pledge by submitting the "Pledge Form" with a tick on "Close Pledge". The pledgee will instruct its DP to confirm the closure of pledge by submitting the "Pledge Form" with a tick on "Confirm Closure of Pledge". The pledge is closed in the system on executing the instruction in the system by both the DPs. A pledgor's DP alone cannot close the pledge. |

| 6. | If the loan in not repaid how does the pledgee take control of the securities? |

| Answer |

If the loan is not repaid, the pledgee, after giving notice to the pledgor as per the terms of the agreement, may instruct its DP to invoke the pledge by submitting the "Pledge Form" with a tick on "Invoke Pledge". On execution of this instruction, the securities are transferred into the pledgee's account. This does not require any confirmation from the pledgor. |

| 7. | Is there a facility in the NSDL system to close or invoke "part quantity" of the pledge? |

| Answer |

Yes. A request can be made for closing or invoking the pledge either in full or in parts. |

| 8. | Who will receive dividend on the pledged securities? |

| Answer |

The pledgor will continue to receive dividend on the pledged securities. The pledgee will get the benefits only if a pledge is invoked and on record date the shares are in the pledgee's account. |

| 9. | How will the distribution of bonus shares for pledged shares happen? |

| Answer |

The software in NSDL has been modified to handle distribution of bonus entitlements through Automatic Corporate Action (ACA) Module. From April 27, 2002, the module will work as follows:

|

| 10. | How will corporate actions like split, mergers, consolidation, etc. be treated? |

| Answer |

The securities arising out of corporate actions like split, mergers, consolidation, etc. will be credited to the account of the pledgor with pledge marked in favour of the pledgee. |

| 11. | What is the procedure for substitution of pledged securities? |

| Answer | Pledge on the securities to be substituted must be created first. After this, the earlier pledge may be closed. |

| 1. | Whether existing pledge form can be used for submitting margin pledge request? |

| Answer | No. A separate Margin Pledge form called ‘Form 43’ needs to be used for submitting margin pledge / re-pledge request. |

| 2. | Whether off market transfer to demat account of Trading Member / Clearing Member (TM/CM) are permitted for margin purposes on or after September 1, 2020? |

| Answer | No, transfer of securities to demat account of the TM/CM for margin purposes (i.e. Title Transfer Collateral Arrangement) is prohibited from September 1, 2020. |

| 3. | Whether holding of Power of Attorney shall be considered as equivalent to the collection of margin by the TM/CM in respect of securities held in the demat account of the client? |

| Answer | No, holding of Power of Attorney shall not be considered as equivalent to the collection of margin by the TM/CM from September 1, 2020. |

| 4. | Can margin pledge be created in any demat account of a trading member (who is not a clearing member for any segment)? |

| Answer | A TM who is not a CM, should open demat account under sub-type ‘TM – Client Securities Margin Pledge Account’. Margin pledge of securities can be done in such a demat account. |

| 5. | For a TM who is also a CM for one or all segments which type of demat a/c should be opened for margin pledge purpose? |

| Answer | A TM who is also a CM may open demat account under sub-type “TM/CM – Client Securities Margin Pledge Account’ and client securities pledged in the said account can in turn be re-pledged with CM (in its capacity as a TM) or CC (in its capacity as a CM) for providing collateral in form of securities as margin. |

| 6. | Which type of demat a/c should be opened by a clearing member to take re-pledge of securities from a trading member for margin pledge purpose? |

| Answer | A CM who wants to take re-pledge of securities from a TM may open demat account under sub-type ‘CM – Client Securities Margin Pledge Account’ and client securities re-pledged in such account can in turn be further re-pledged with clearing corporation (CC) for providing collateral in form of securities. |

| 7. | Whether client can margin pledge the securities directly to clearing member? |

| Answer | No. Client can initiate the Margin Pledge either to the ‘TM – Client Securities Margin Pledge account’ or to the ‘TM / CM – Client Securities Margin Pledge account’. |

| 8. | Whether any stamp duty would be applicable in case of Margin pledge transaction? |

| Answer | In case of Margin Pledge invocation, stamp duty would be applicable and payable before the execution of invocation of the Margin Pledge by the concerned trading member / clearing member / clearing corporation. |

| 9. | Whether my stock broker can transfer the funded stocks to ‘Client Securities under Margin Funding Account’? |

| Answer | No. The funded stocks can be held in ‘Client Securities under Margin Funding Account’ of trading member only by way of margin pledge. |

| 10. | Whether execution of margin pledge of funded stocks in ‘Client Securities under Margin Funding Account’ would require OTP confirmation from the client? |

| Answer | Yes. |

| 11. | Whether OTP confirmation would be required if the securities are being re-pledged? |

| Answer | No. |

| 12. | How will the OTP confirmation by client for margin pledge work? |

| Answer | On receipt of margin pledge instruction either from a client or TM (based on the POA), a link to ‘Confirm Margin Pledge Transactions’ would be generated and sent by NSDL through SMS on registered mobile number and registered e-mail id in the demat account of a client. On clicking the said link, client will be redirected to a web page where client will be authenticated with “PAN” (not applicable in case of PAN exempt clients), After authentication, client will be displayed the details of outstanding margin pledges for the specific TM and client can generate the One Time Password (OTP) through the same link and OTP will be sent on the registered mobile number and registered e-mail id of the client. On OTP authentication, margin pledge transaction would be processed further. |

| 13. | What is the significance of Unique Client Code (UCC) for margin pledge transactions? |

| Answer | Margin Pledge instruction can be initiated in favour of a trading member only if the UCC allotted to the client by trading member is linked in the demat account of the Client. Validation of the margin pledge instruction will be done with the UCC database (i.e. Client UCC, TM ID, Segment) which is linked in the demat account of the Client. |

| 14. | Whether the margin pledge instruction can be given electronically? |

| Answer |

Yes. Margin pledge instruction can be given electronically through NSDL e-services – SPEED-e platform. |

| 15. | How the OTP for Margin Pledge confirmation will be sent to NRI clients? |

| Answer | OTP will be sent to NRI clients at email ID registered in their demat account. |

| 16. | Whether re-pledge transactions will be shown in client’s demat account statement? |

| Answer | Yes. Margin pledge and re-pledge transactions shall be shown in client’s account against each security provided as collateral to a TM, and in whose favour i.e. TM / CM / CC. |

| 17. | How will the margin pledge/ re-pledged securities be released? |

| Answer | Client can initiate release of margin pledge request for the securities pledged/ re-pledged with TM/CM/CC. Alternatively, TM/CM/CC can initiate a unilateral release of pledged/re-pledged securities. |

| 18. | What are the charges payable to DP for margin pledge? Whether the pledge charges as applicable currently would apply to margin pledge also? |

| Answer | You may find the charges payable to your DP for margin pledge and re-pledge transactions from your DP. These charges may be different from the charges payable for pledge. Charges that are charged by NSDL to DPs are available at https://nsdl.co.in/about/charges.php |

| 1. | If my depository account is with NSDL, can I receive my securities from an account holder having account with some other depository in India? |

| Answer | Yes. Inter depository transfers are possible. |

| 1. | What is the meaning of lending and borrowing of securities? How does it work? |

| Answer |

Securities Lending and Borrowing Scheme (SLBS) is a mechanism by which short sellers can borrow the required securities on the stock exchange platform to meet their delivery obligations or as collaterals. This scheme is run by clearing corporations which are registered as ‘Approved Intermediaries’. Stockbrokers who register themselves as ‘Participant’ with the Approved Intermediary, may participate in SLBS for their own account or on behalf of their clients. Retail investors may participate in the scheme through their stockbroker as lender or borrower. Lending and borrowing are effected through the depository system on a T+ 1 settlement basis. SLBS is permitted in dematerialized form only. |

| 2. | What are benefits of lending and borrowing of securities? |

| Answer | SLBS is a market based system which helps to meet the temporary need of the securities. Short sellers may meet their delivery obligation or collateral requirement by borrowing the securities from the market. Lenders on the other hand are able to earn lending fee by lending the securities lying idle in their portfolio. |

| 3. | Can I lend the securities lying in my account? |

| Answer | Yes. You can lend your securities through your stockbroker who has registered itself as ‘Participant’ with the ‘Approved Intermediary’ (clearing corporation). You need to enter into a standard agreement with your stockbroker. |

| 4. | What is the period for which securities can be lend or borrowed? |

| Answer | The tenure of lending and borrowing may be between 1 to 12 months. However, lenders and borrowers do have the option of recall of securities and early return of securities, respectively. |

| 5. | Whether any security can be used for lending and borrowing? |

| Answer | No. Securities, which are available for trading in Futures and Options segment of the stock exchange, are available for lending and borrowing at present. The list of securities eligible under SLBS are periodically announced by the respective approved intermediaries. |

| 6. | How would I lend securities lying in my demat account? |

| Answer | You may place your order to your broker for lending the securities. Your broker will enter the order on the platform of the stock exchange. After successful execution of the order, you will need to give delivery instruction slip to your broker for the purpose of payin. |

| 7. | How would I get back the securities lent by me? |

| Answer | Borrower of securities may return the securities at the end of the agreed period of lending or before it (if foreclosure of transaction is permitted by approved intermediary for that security). Upon return, securities will be credited to your demat account through your broker or directly by the clearing corporation. |

| 8. | How would I receive the corporate benefits may accrue on the securities during the period of lending? |

| Answer | Securities in which there are corporate actions are subject to either foreclosure of transaction or adjustment depending on the type of corporate action. All transactions in case of corporate actions other than dividend and stock-spilt are foreclosed on the ex-date. In case of dividend, the dividend amount is collected from the borrower by clearing corporation and paid to the lender. In case of stock split, the position of the borrower is proportionately adjusted and the lender will receive the revised quantity on the reverse leg settlement date. |

| 9. | How can I borrow to fulfil my temporary need of securities? |

| Answer | You may place your order with your broker specifying the details (like name and quantity of securities required, borrowing period). Your broker will enter your order in exchange platform. Upon receiving the pay-out, your broker will arrange the credit of securities in your demat account. You will need to return the borrowed securities at the end of period (or before it, if so desired and permitted by the approved intermediary). |

| 1. | What is the importance of record date? |

| Answer | Record date is the date, which is taken as cutoff day by a company to consider the list of shareholders for the purpose of distribution of any type of corporate benefit. You would be entitled to receive the benefits as declared by the company if your name appears in the list of shareholders as on the ‘record date’. Therefore, it is important for you to ensure that securities bought by you are transferred to your account by your broker before record date. |

| 2. | How would I get my dividend / interest or other cash entitlements? |

| Answer | The concerned company obtains the details of beneficiary holders from NSDL as on the record date. The due amount is credited to the linked bank account of the demat account holder directly by the company. |

| 3. | How would I get bonus shares if I am holding shares in demat form? |

| Answer | The concerned company obtains the details of beneficiary holders and their holdings from NSDL as on the record date. The number of shares you are entitled for, are credited to your demat account by the company / its RTA. |

| 4. | How do I confirm that bonus / rights entitlement credited in my demat account is correct? |

| Answer | An allotment advice is issued by the Issuer company / its RTA for bonus / rights entitlement. You should check the same with the demat account statement received by you. The quantity shown in the advice and account statement should match. |

| 1. | Can I dematerialise my debt instruments, mutual fund units, government securities also in my demat account ? |

| Answer | Yes. You can dematerialise and hold all such investments in a single demat account. |

| 1. | What type of debt instruments can be admitted in NSDL? |

| Answer | NSDL has no restriction on type of instruments that can be admitted in the depository. Instruments like Bonds, Debentures, Commercial Papers, Certificate of Deposit, etc. irrespective whether these instruments are listed/unlisted/privately placed or even issued to a single holder can be dematerialized. |

| 2. | What will be the cost involved for admitting Debt Instruments? |

| Answer | NSDL does not charge any fee one-time or on recurring basis from issuer for admitting any securities for dematerialisation. The only cost that will have to be borne by the company is towards electronic connectivity with NSDL. Electronic connectivity can obtained either through setting up in-house connectivity or through appointing a Registrar & Transfer Agent connected with NSDL. |

| 3. | How can a company admit its debt instruments in NSDL? |

| Answer | Company has to send a request to NSDL detailing type of instrument alongwith a Letter of Intent. On receipt of request, a tripartite agreement will be signed between NSDL, Issuer and Registrar & Transfer Agent. Ones admitted, these securities would be made available for dematerialisation by NSDL. |

| 4. | Do the company have to sign a separate agreement for admitting its debt instrument if its equity shares are already admitted on NSDL? |

| Answer | No. The same terms and conditions of the existing bipartite/tripartite agreement will be applicable for the debt instruments. The Issuer has to provide a confirmation on the same to NSDL before admitting the securities. |

| 5. | Will debt instruments be separately identified from equity in the NSDL system? |

| Answer | Each instrument will be identified separately in NSDL system through a unique code called ISIN. Description of each instrument will be communicated to all the DP and Issuers on activation. |

| 6. | Do the company have to sign a separate agreement for admitting its debt instrument if its equity shares are already admitted on NSDL? |

| Answer | No. The same terms and conditions of the existing bipartite/tripartite agreement will be applicable for the debt instruments. The Issuer has to provide a confirmation on the same to NSDL before admitting the securities. |

| 7. | Unlike equity shares, each debt instruments have unique features. Would this hinder their admission in NSDL? |

| Answer | Unique characteristic of each instrument will be incorporated in the company and security descriptor in NSDL system. The coupon rate and the date/year of maturity are a part of the standard descriptor. This will enable both Investors and the Depository Participants to easily identify these instruments. |

| 8. | Can debt instrument be directly allotted in dematerialized form? |

| Answer | Any new instrument can be issued directly in dematerialized form without recourse to printing of either Letter of Allotment or Certificates. Securities will be directly credited into the accounts of the investor by NSDL on receipt of allotment details from Issuer/Registrar & Transfer Agent. |

| 9. | Can letter of allotment be directly issued in demat form? |

| Answer | Letter of allotment (LOA) issued to investors prior to issue of debenture certificates can be issued in demat form. On creation of charge, the issuer will have to submit the corporate action information form for conversion of LOA to Debentures/ Bonds and the description of the security will be changed in the system to reflect the conversion. |

| 10. | Do the company has to pay stamp duty on securities issued directly in dematerialized form? |

| Answer | Yes, the Issuer has to pay the relevant stamp duty as applicable irrespective whether it is issued in either physical or demat form. As per the Finance Act 2000, stamp duty is waived only for transfers within the depository. |

| 11. | How is redemption of a debt instrument handled in dematerialised form? |

| Answer | One way of handling of redemption in dematerialised form is through transfer of all balance under the instrument (i.e. ISIN) to a demat account opened by issuer for the purpose. Prior to the date of redemption, the issuer has to complete all formalities associated with redemption in physical form. On the day of redemption, a debit-credit action will be undertaken wherein all balances under the instrument will be transferred to say, an Issuer Redemption Account. Alternatively, on receipt of information regarding completion of statutory requirements for redemption, ISIN will be deactivated in NSDL. |

| 12. | How is interest payment carried out for holdings in dematerialised form? |

| Answer | Interest payment for debt instruments will be handled in the same way as corporate benefits are handled for equity. On communication of record date by the Issuer, beneficiary position will be downloaded to the Issuer/Registrar by NSDL. In addition to the above statutory requirement, NSDL provides weekly download of beneficiary position to all Issuer/Registrar. |

| 13. | How will depository handle those instruments having call/put options? |

| Answer | Exercising of call/put option only prepones the redemption date of an instrument. On exercising call option by the company, the same procedure will be followed as in normal redemption. For put option, once the same is exercised by all/part of the investors, the details of which is communicated by the Issuer a debit action will be carried out by NSDL for those accounts of the investors. |

| 1. | Does one have to open a separate account for dematerialisation of debt instruments? |

| Answer | It depends upon the convenience of investor whether one wants to open a separate account for debt instruments. NSDL has no restriction if existing account or multiple accounts are used for dematerialisation of debt instruments. |

| 2. | How can one dematerialise debt instrument? |

| Answer | Procedure for dematerialisation of debt instrument is same as that carried out for equity shares. In order to dematerialise his/her certificates; an investor will have to first open an account with a DP and then request for the dematerialisation of certificates by filling up a dematerialisation request form [DRF], which is available with DP and submitting the same alongwith the physical certificates. The investor has to ensure that before the certificates are handed over to the DP for demat, he marks "submitted for dematerialisation" on the face of the certificates. |

| 3. | Will the DP provide a separate Statement of Holding for Debt Instruments? |

| Answer | No. Single statement of holding will reflect all holdings in a particular account irrespective of type of instrument. Along with Statement of Holding, the DP's will also provide periodically each client with a Statement of Transaction giving the details of all transaction during the period under each depository account. |

| 4. | If one has to buy/sell any debt instrument, what are the procedures involved in dematerialised form? |

| Answer | Procedure involved for delivery or receipt of debt instrument will be same as involved for equity shares. |

| 5. | What are the charges involved in dematerialisation of debt instruments? |

| Answer | NSDL does not charge any fee for dematerialisation of certificates from depository participants. DPs are free to charge any charges towards dematerialisation from its clients. A detailed fee structure charged by NSDL from DP's is provided in the Fee Structure Schedule. |

| 6. | How is interest received for instruments held in dematerialised form? |

| Answer | Payment of interest is handled in the same way as corporate benefit like dividend in equity. List of beneficiary holders as on book closure date consisting of Holder Name and account number, address, bank details and DP ID is downloaded to the Issuer. Based on the information provided above, the issuer dispatches interest warrants to the holders of dematerialised instruments. |

| 7. | How is 'put' option exercised in dematerialised form? |

| Answer | On exercising put option by an investor, a debit corporate action will be carried by NSDL where the balance under the instrument is reduced to zero. The details of put option exercised by investors will be provided by the company to NSDL. |

| 8. | How can securities be allotted directly in dematerialised form? |

| Answer | Procedure followed will be identical to that followed for direct credit of equity shares during IPO/Bonus/Rights. The issuer will provide an option for allotment of securities in demat form in its issue prospectus. Investors opting for demat will have to provide demat account number alongwith DP ID in their application form. On being allotted, a direct credit will be carried out in accounts of the allottees. |

| 1. | How can a company admit its Commercial Paper(CP) in NSDL? |

| Answer | The company has to sign a tripartite/bipartite agreement with NSDL. If the company has admitted any of its securities in NSDL (shares, debentures, etc.) and wishes to appoint the same R & T agent for CP, then the company need not sign a separate tripartite / bipartite agreement. Company has to send a Letter of Intent (LoI) and a Master File Creation Form (MCF) for admitting its securities. Once admitted these securities would be made available for dematerialisation by NSDL. |

| 2. | What is the denomination in which the issuer can issue the CP? |

| Answer | Commercial paper can be issued in multiples of ₹5 lakh. The face value of the CP by default will be taken as ₹5 lakh in the NSDL system. The securities (CP) will be credited in the IPAs allotment account in terms of units. For e.g. If the company proposes a ₹50 crore issue, then 1000 units will be credited in the IPAs allotment account. |

| 3. | Does the company have to sign a separate agreement for admitting its Commercial Paper if its equity shares and/or debt instruments are already admitted on NSDL? |

| Answer | No. The same terms and conditions of the existing bipartite/tripartite agreement will be applicable for the CP. Only, a LoI and a MCF submitted by the issuer is sufficient. |

| 4. | Will CP be separately identified from equity in the NSDL system? |

| Answer | Each instrument will be identified separately in NSDL system through a unique code called International Securities Identification Number (ISIN). Description of each instrument will be communicated to all the Depository Participants and Issuers on activation of ISIN in NSDL system. |

| 5. | How much time it will take to allot an ISIN by NSDL? |

| Answer | On the receipt of LoI alongwith duly filled in MCF and requisite documents complete in all respects, an ISIN will be allotted on the same day. |

| 6. | How CP issued by Issuer will be distinguished from its equity shares? |

| Answer |

The company name will be accompanied by CP alongwith date/year of maturity as a part of the standard descriptor. This will enable both Investors and the Depository Participants to easily identify these instruments. e.g. RIL 90D CP 10NV00 indicates 90 day (duration of the paper) CP issued by Reliance Industries with maturity date as November 10, 2000. If the CP is allotted on different days say for 89 days to one investor, 88 days for another investor, the number of days in the descriptor will indicate the number of days the Issuer has provided NSDL at the time of the activation of the ISIN. Also, if the CP has been provided a backstop facility then the descriptor changes to RIL 90D CP 10NV00-BS. |

| 7. | Can CP be directly allotted in dematerialized form? |

| Answer | A CP shall be issued in the form of a promissory note and held in dematerialized form. |

| 8. | Does the company have to pay stamp duty on securities issued directly in dematerialized form? |

| Answer | Yes. The Issuer has to pay the relevant stamp duty as applicable. The stamp duty may be paid online and the Electronic - Secure Bank and Treasury Receipt (e-SBTR) may be submitted to the IPA alongwith the usance promissory note. In case the issuer is not in a position to make payment of stamp duty through e-SBTR, it can make the payment as per the manual process and submit a payment challan copy to IPA. |

| 9. | What is the recourse to the investors if the Issuer defaults in making the payment? |

| Answer | As per the FIMMDA guidelines, in case of default in payment by the issuer, the IPA will intimate the investors, the depositories, R&T Agents, trustee (if any) and the credit rating agencies. The holders would have recourse to the Issuer and stand-by credit provider (through trustee, if any), on the strength of default advice received from IPA. |

| 10. | What will be the cost involved for admitting Commercial Paper in NSDL? |

| Answer | In case of corporate action of CPs, a flat rate of ₹10,000/- is levied on the Issuer for 5 normal corporate actions. Additional fee of ₹10,000/- for every additional five issues. |

| 11. | Are R&T agent charges guided by NSDL or are they to be decided by Issuer and R&T? |

| Answer | No. It is to be agreed between the issuer and the RTA. |

| 12. | Whether Stand by facility is required to be provided by the bankers/FIs for CP issue? |

| Answer |

CP being a ‘standalone’ product, it would not be obligatory in any manner on the part of banks and FIs to provide stand-by facility to the issuers of CP. However, Banks and FIs have the flexibility to provide for a CP issue, credit enhancement by way of stand-by assistance/credit backstop facility, etc., based on their commercial judgement and as per terms prescribed by them. This will be subjected to prudential norms as applicable and subject to specific approval of their Board. |

| 13. | Whether non-bank entities/corporates can provide guarantee for credit enhancement of the CP issue? |

| Answer | Yes. Non-bank entities including corporates can provide unconditional and irrevocable guarantee for credit enhancement for CP issue provided that the offer document for CP properly discloses the net worth of the guarantor company, the names of the companies to which the guarantor has issued similar guarantees, the extent of the guarantees offered by the guarantor company, and the conditions under which the guarantee will be invoked. |

| 14. | Whether CP can be underwritten? |

| Answer | Issuer shall have the issue of Commercial Paper underwritten or co-accepted. |

| 15. | What are the duties and obligations of the Issuer, IPA and Credit Rating Agency? |

| Answer | Issuer: The issuer of CP shall -

IPA: The IPA for a CP issuance shall

Credit Rating Agency (CRA):

|

| 16. | Is there any formats specified by FIMMDA for Letter of offer and IPA certificate? |

| Answer | Yes. FIMMDA has specified the formats for letter of offer to be issued by CP issuer and IPA certificate to be issued by IPA in its Operational guidelines on CPs. |

| 1. | What is Commercial Paper (CP)? |

| Answer | Commercial Paper (CP) is an unsecured money market instrument issued in the form of a promissory note. |

| 2. | Who can issue CP? |

| Answer |

Companies, including Non-Banking Finance Companies (NBFCs) and All India Financial Institutions (AIFIs), are eligible to issue CPs subject to the condition that any fund-based facility availed of from bank(s) and/or financial institutions is classified as a standard asset by all financing banks/institutions at the time of issue. Other entities like co-operative societies/unions, government entities, trusts, limited liability partnerships and any other body corporate having presence in India with a net worth of ₹100 crore or higher subject to the condition as specified under (a) above. Any other entity specifically permitted by the Reserve Bank of India (RBI). |

| 3. | Who can Invest CP? |

| Answer |

All residents, and non-residents permitted to invest in CPs under Foreign Exchange Management Act (FEMA), 1999 are eligible to invest in CPs; however, no person can invest in CPs issued by related parties either in the primary or secondary market. Investment by regulated financial sector entities will be subject to such conditions as the concerned regulator may impose. |

| 4. | What is the minimum and maximum period of maturity prescribed for CP? |

| Answer | CP can be issued for maturities between a minimum of 7 days and a maximum of up to one year from the date of issue. However, the maturity date of the CP should not go beyond the date up to which the credit rating of the issuer is valid. |

| 5. | In what denominations a CP can be issued? |

| Answer | CP can be issued in denominations of Rs.5 lakh or multiples thereof. |

| 6. | Whether CP can be issued on different dates by the same issuer? |

| Answer | Yes. CP may be issued on a single date or in parts on different dates provided that in the latter case, each CP shall have the same maturity date. Further, every issue of CP, including renewal, shall be treated as a fresh issue. |

| 7. | Is there any rating requirement for issuance of CP? |

| Answer | Yes. |

| 8. | What is the rating requirement? |

| Answer |

Eligible issuers, whose total CP issuance during a calendar year is ₹ 1000 crore or more, shall obtain credit rating for issuance of CPs from at least two Credit Rating Agencies registered with SEBI and should adopt the lower of the two ratings. Where both ratings are the same, the issuance shall be for the lower of the two amounts for which ratings are obtained. The minimum credit rating for a CP shall be ‘A3’ as per rating symbol and definition prescribed by SEBI. |

| 9. | Who can act as Issuing and Paying Agent (IPA)? |

| Answer | Any scheduled bank can act as an IPA for issuance of CP. |

| 10. | Whether CP is to be issued and held only in dematerialised form? |

| Answer | Yes. A CP will be issued in the form of a promissory note and will be held only in dematerialised form through any of the depositories approved by and registered with SEBI. |

| 11. | Whether CP is always issued at a discount? |

| Answer | Yes. CP is issued at a discount to face value as may be determined by the issuer |

| 12. | Does one have to open a separate account for holding dematerialisation of CP in dematerialised form? |

| Answer | The investor can hold CP in same account along with other securities like equity, debentures, bonds, etc. However, if an investor desires, the investor can hold the CP in a separate demat account also. NSDL has no restriction if existing account/different accounts are used for holding CPs in dematerialised form. |

| 13. | Whether CPs are traded in the secondary market? |

| Answer | Yes. CPs are actively traded in the OTC market. Such transactions are to be reported to the Financial Market Trade Reporting and Confirmation Platform (“F-TRAC”) of Clearcorp Dealing System (India) Ltd. within 15 minutes of the trade by all eligible market participants. |

| 14. | If one has to buy/sell any CP, what is the procedure involved in dematerialised form? |

| Answer | Buyer and Seller decide upon price and quantity of securities to be transacted. Seller authorises its DP through delivery instructions to debit his account and transfer the securities into the account of Buyer who may have opened account with the same or any other DP. Buyer receives the securities in its account immediately if the buyer has provided standing instruction to its DP. Settlement of funds is between the parties as agreed between them. |

| 15. | What are the charges involved in undertaking transfer of CP held in demat account? |

| Answer | Commercial Paper For account transfers, NSDL charges the DPs and not the investors. NSDL's charges to its DPs are fixed and are based on the usage of NSDL system. Complete details of NSDL charges as are payable by the DPs are available on NSDL website (www.nsdl.co.in). The charge payable by the investor to the DP is determined as per the agreement between the investor and the DP |

| 16. | Will the investor receive a separate statement containing the holding / transactions for CP? |

| Answer | No. A single consolidated account statement received by investor will reflect all holdings and transactions in a particular account irrespective of type of instrument(s). |

| 17. | Click here to know the list of Instruments available for Commercial Paper |

| 1. | How can a Issuer admit its Certificate of Deposit in NSDL? |

| Answer | Sign a tripartite/bipartite agreement with NSDL. The Issuer has to send the Master Creation Form to NSDL providing the details of instrument along with a Letter of Intent. Once admitted, these securities would be made available for dematerialisation by NSDL. |

| 2. | Does the Issuer have to sign a separate agreement for admitting its Certificate of Deposit if its equity shares and/or debt instruments, Commercial Paper are already admitted on NSDL? |

| Answer | No. The same terms and conditions of the existing bipartite/tripartite agreement will be applicable for the Certificate of Deposit. |

| 3. | What is the denomination in which issuer can issue the Certificate of Deposit? |

| Answer | Certificate of Deposit can be issued in multiples of Rs. 1 lakh. The face value of the CD by default will be taken as Rs. 1 lakh in the NSDL system. The securities (CDs) will be credited in the investor's account in terms of units. For e.g. If the Issuer proposes a 1 crore issue, then 100 units will be credited in the Investors account. |

| 4. | Yes, the Issuer has to pay the relevant stamp duty as applicable irrespective whether it is issued in either physical or demat form. |

| Answer | Does the Issuer have to pay stamp duty on securities issued directly in dematerialized form? |

| 5. | Will Certificate of Deposit be separately identified from equity in the NSDL system? |

| Answer | Yes, each type of security like Equity Shares, Debentures, bonds, Commercial Paper etc. is identified separately in the NSDL System by a unique code called ISIN (International Securities Identification Number). Certificate of Deposits having different maturity dates will be identified separately in NSDL system through separate ISINs. However Certificate of Deposits having the same maturity date will be identified by the same ISIN irrespective of the date of allotment. Description of each ISIN will be communicated to all the DP and Issuers on the activation of ISIN in NSDL system. |

| 6. | How Certificate of Deposit issued by Issuer will be distinguished from its equity shares/debentures/bonds/ Commercial paper? |

| Answer | The Issuer Name will be accompanied by CD (Certificate of Deposit) alongwith date/year of maturity as a part of the standard descriptor. This will enable both Investors and the Depository Participants to easily identify these instruments. e.g. ICICI Bank CD 10NV05 indicates Certificate of Deposit issued by ICICI Bank Limited with maturity date as November 10, 2005. |

| 7. | Can Certificate of Deposit be directly allotted in dematerialized form? |

| Answer | As per the RBI Monetary and Credit Policy 2002-03, with effect from June 30, 2002, banks and FIs should issue CDs only in the dematerialised form. A new CD can be issued directly in demat form without recourse to printing of Certificates. Securities will be directly credited into the allotment account of the investor's by NSDL on receipt of allotment details from Issuer/Registrar & Transfer Agent. The issuance in demat form will be in accordance with the Fixed Income Money Market and Derivatives Association of India (FIMMDA) Guidelines on issuance of CD's, details of which are available on the www.fimmda.org. |

| 8. | What are the steps to be taken to allot CDs directly in demat form? |

| Answer | The steps to be taken for allotting CDs in demat form are enumerated in the Process Flow. |

| 9. | Can credit of CD take place in the accounts of the investors on the day of receipt of payment? |

| Answer | According to the guidelines issued for the CD by the FIMMDA the Issuer has to ensure that the investor receives the credit (of the CD) in his demat account latest by the following working day from the date of realization of the cheque. |

| 10. | How can one dematerialise existing Certificate of Deposit? |

| Answer | The procedure for dematerialisation of Certificate of Deposit is same as that carried out for equity shares. Investor shall submit the Certificate of Deposit alongwith demat request form (which is available with DP) to the DP. Only those Certificates of Deposit, which have been made available for dematerialisation by its Issuer, can be dematerialized. |

| 11. | How is redemption of a Certificate of Deposit handled in dematerialised form? |

| Answer |

The Issuer has to open a redemption account with Depository Participant (DP). The details of the Redemption Account (DP_ID, Client ID) have to be provided at the time of activation of ISIN. The Investors holding CDs in demat form will give the Delivery Instruction Slip (DIS) to their respective Depository Participants to transfer the CDs to the Issuers Redemption Account so that the transfer takes place by 3.00 p.m. atleast two working days prior to the maturity date. After the confirmation from the Issuer to NSDL on payment of redemption proceeds to all the investors, the balance in the redemption account is extinguished by carrying out debit-type corporate action of the redemption account. The Depository Registrar (at the Issuers instance) in co-ordination with NSDL will initiate this corporate action. |

| 12. | How does the Issuer ensure the receipt of redeemed Certificate of Deposit & make payment for the same? |

| Answer | As per the FIMMDA guidelines, the investor after giving the transfer instructions as mentioned above should also communicate to the issuer the place at which the payment is request by a letter/fax enclosing the copy of the DIS it had given to its DP. On the receipt of Certificate of Deposit in the redemption account, the issuer will make payment to the investors. |

| 13. | How is the details of beneficial holders will be communicated to the issuer? |

| Answer |

The issuer can request for beneficiary download on T-2 settlement date or as on the record date. This beneficiary position will only indicate the details of the CD holders to the Issuer as on that particular date but will no way imply that redemption amount will be paid to the above beneficiary holders. Redemption amount will be paid to the investor who finally transfers the balances to the Issuers redemption account. This is considered as a statutory download and is free of cost. In addition, NSDL on a weekly basis provides the download of beneficiary position to all the Registrars (on every Friday - there is no need for an issuer to solicit a special benpos on a Friday). Issuers can take the details from the registrar. The same can be exported to the back office of the Registrar & Transfer agent on Saturday morning. NSDL also provides downloads of beneficiary position as and when requested by the Issuer. For these type of download NSDL charges a flat fee of Rs 5000 where number of records are less than 10,000 and a fee of Rs 10,000 for records exceeding 10,000. |

| 14. | What will happen to the ISIN after redemption? |

| Answer | The ISIN will be freezed at the end of the redemption date. It will be done so only after the Issuer confirms that all the investors have been paid the redemption proceeds. |

| 15. | Whether the Rollover of the Certificate of Deposit will be treated as fresh issue of CD by NSDL? |

| Answer | Yes, A new ISIN has to be generated to identify these rolled over Certificate of Deposit separately in the NSDL system, as the date of maturity will be different. However in case an ISIN already exists for the maturity date of the rolled over CD, then the Issuer can directly do the allotment in the existing ISIN. |

| 16. | What will be the cost involved for admitting Certificate of Deposit in NSDL? |