The facility of BSDA with limited services for eligible individuals was introduced with the objective of achieving wider financial inclusion and to encourage holding of demat accounts. As per SEBI directions, No Annual Maintenance Charges (AMC) shall be levied, if the value of securities holding in the Demat Account (Debt as well as other than debt securities combined) is upto Rs. 4 lakhs.For value of securities holding in Demat Account (Debt as well as other than debt securities combined) is more than between Rs 4 lakhs but upto Rs.10 lakhs,AMC not exceeding Rs 100 is chargeable.

- Receive a copy of KYC, copy of account opening documents.

- No minimum balance is required to be maintained in a demat account.

- No charges are payable for opening of demat accounts.

- If executed, receive a copy of Power of Attorney. However, Power of Attorney is not a mandatory requirement as per SEBI / Stock Exchanges. You have the right to revoke any authorization given at any time.

- You can open more than one demat account in the same name with single DP/ multiple DPs.

- Receive statement of accounts periodically. In case of any discrepancies in statements, take up the same with the DP immediately. If the DP does not respond, take up the matter with the Depositories.

- Pledge and / or any other interest or encumbrance can be created on demat holdings.

- Right to give standing instructions with regard to the crediting of securities in demat account.

- Investor can exercise its right to freeze / defreeze his/her demat account or specific securities / specific quantity of securities in the account, maintained with the DP.

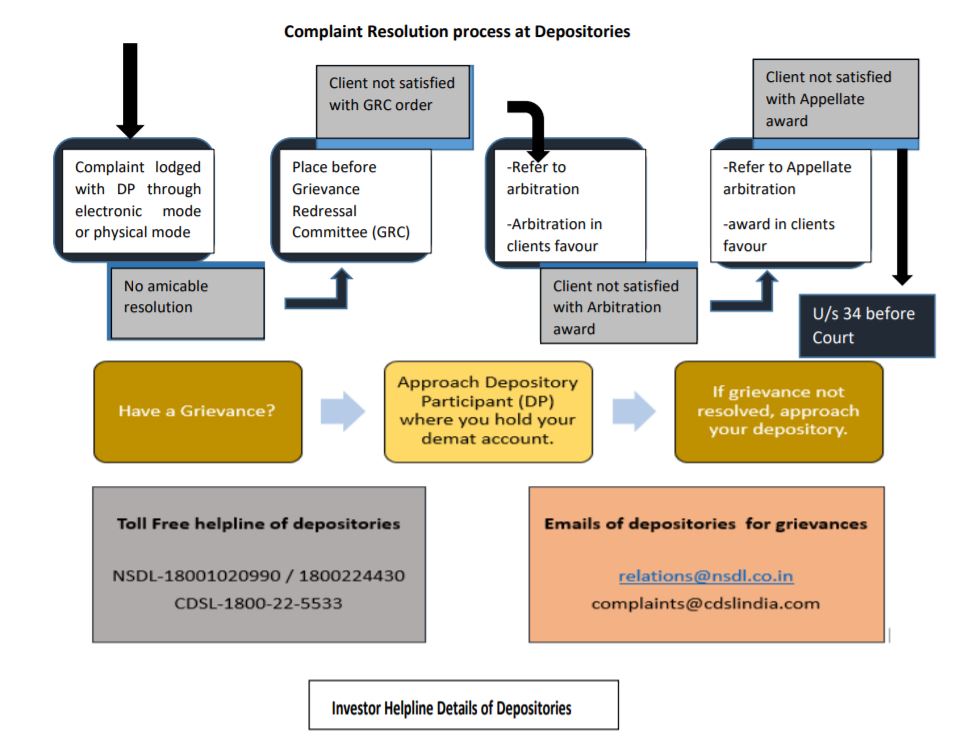

- In case of any grievances, Investor has right to approach Participant or Depository or SEBI for getting the same resolved within prescribed timelines.

- Every eligible investor shareholder has a right to cast its vote on various resolutions proposed by the companies for which Depositories have developed an internet based ‘e-Voting’ platform.

- Receive information about charges and fees. Any charges/tariff agreed upon shall not increase unless a notice in writing of not less than thirty days is given to the Investor.

- Right to indemnification for any loss caused due to the negligence of the Depository or the participant.

- Right to opt out of the Depository system in respect of any security.

![relations[at]nsdl[dot]co[dot]com](../images/email_id1.png)