Margin Pledge

Margin is the amount and / or security an investor must pay to his / her stock broker before executing a trade. Margin requirements are prescribed by SEBI and enforced by the stock exchanges.

Margin Trading is a facility provided by stock broker to clients whereby an client can buy or sell securities without paying 100% amount upfront towards purchase consideration or 100% shares that are sold. The part paid by the investor is called ‘Margin’ and the portion that is not paid is the leverage given to client by the broker.

Investor can pay the margin in form of cash payment or by depositing securities. Securities provided as margin are also known as ‘Collateral’.

How does Margin Pledge work?

|

As per SEBI’s guidelines, w.e.f. August 1, 2020, collaterals in form of securities can be accepted by stock brokers only in form of margin pledge created on the securities held in client’s demat account.

Instruction to create margin pledge on securities can be given by client or by the person holding the Power of Attorney, in physical form or electronically through SPEED-e.

Such margin pledge can be created in favour of a specially designated demat account of the stock broker (opened as TM – Client Securities Margin Pledge Account or TM / CM – Client Securities Margin Pledge Account).

|

How to submit Margin Pledge Instruction?

There are three ways to submit Margin Pledge Instructions –

-

You may fill up, sign and submit

‘Form 43 – Margin Pledge Form’

in paper form to your DP.

-

You may submit Margin Pledge Instruction electronically using

NSDL SPEED-e

platform, if you are a registered user (password user or e-token user).

-

Your stock broker (Trading Member) may initiate Margin Pledge instruction on your behalf if you have given a Power of Attorney (POA) in his favour.

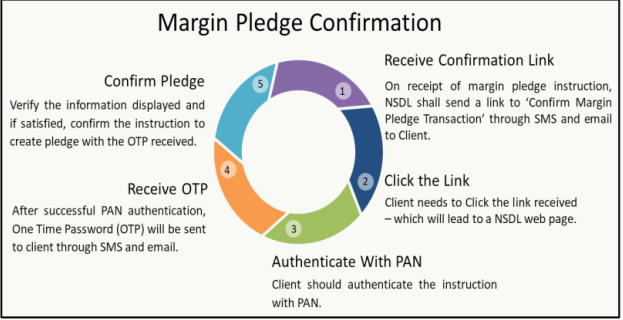

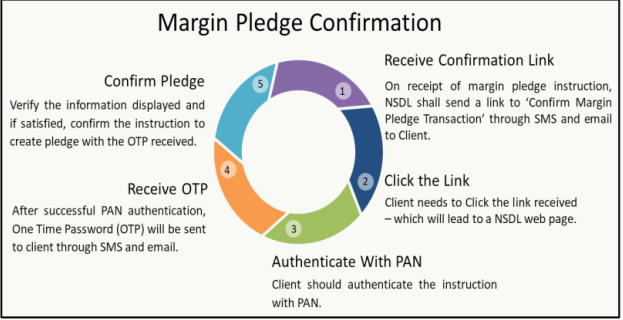

- In this case, you will need to confirm the Margin Pledge instruction using OTP received on your registered mobile number or registered email ID.

|

Points to keep in mind for Margin Pledge creation

-

Once created, margin pledge instruction will wait for pledgee’s confirmation to become effective

-

If the pledgee has opted for automatic confirmation of pledge instruction, then margin pledge instruction created as above will become effective immediately.

-

Make sure to create a margin pledge for securities that are approved by your stockbroker for margin purposes.

-

Create margin pledge for quantity according to the value of the security and haircut applicable

-

Upon creation of margin pledge on securities, no transfer, hold, pledge, hypothecation, lending, rematerialisation or alienation of securities in any manner shall be permitted, unless the margin pledge on securities is released or invoked.

|

How to Close Margin Pledge?

-

Submit Closure Instruction - Client can submit instruction for Closure of Margin Pledge existing in his / her demat account in physical form or electronically through SPEED-e

-

Confimation by Pledgee - Pledge will be closed when it is confirmed by the concerned stock broker (pledgee TM)

-

Instruction by Broker - Alternatively, stock broker can give an instruction for unilateral closure of the pledge

|

What is Invocation of Margin Pledge?

|

In case of default in payment by client, Stock Broker (TM) can submit instruction for Invocation of Pledge existing in its favour in physical form or electronically through SPEED-e facility.

|

|

Upon successful execution of Pledge Invocation instruction in NSDL system, securities will be debited from the client’s demat account (Pledgor’s account) and credited to TM’s demat account (Pledgee’s account).

|