Depository System - Business Partners

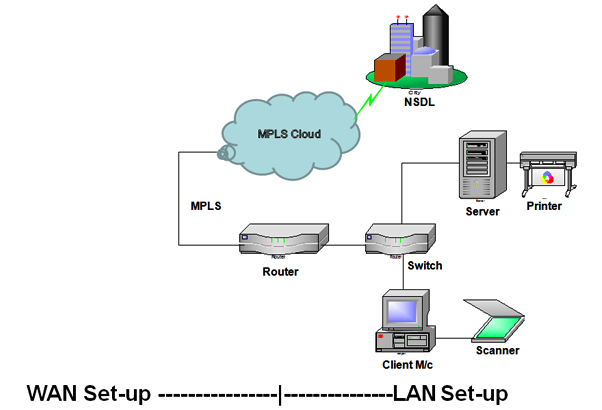

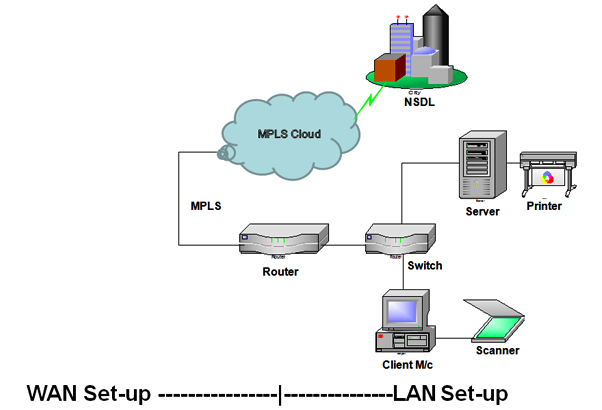

NSDL carries out its activities through various functionaries called "Business Partners" which include Depository Participants (DPs), Issuer companies and their Registrars and Share Transfer Agents, Clearing corporations of Stock Exchanges. NSDL is electronically linked to each of these business partners through MPLS (Multi Protocol Label Switching). The entire integrated system (including the electronic links and the software at NSDL and each business partner's end) is called the "NEST" [National Electronic Settlement & Transfer] system.

The investor obtains Depository Services through a DP of NSDL. A DP can be a bank, financial institution, a custodian, a broker, or any entity eligible as per SEBI (Depositories and Participants) Regulations, 2018. The SEBI regulations and NSDL bye laws also lay down the criteria for any of these categories to become a DP.

Just as one opens a bank account in order to avail of the services of a bank, an investor opens a depository account with a DP in order to avail of depository facilities. Though NSDL commenced operations with just three DPs, Depository Participant Services are now available in most of the major cities and towns across the country.

Securities issued by issuers who have entered into an agreement with NSDL can be dematerialised in the NSDL depository. As per this agreement, issuer agrees to verify the certificates submitted for dematerialisation before they are dematerialised and to maintain electronic connectivity with NSDL. Electronic connectivity facilitates dematerialisation, rematerialisation, daily reconciliation and corporate actions.

The clearing corporations/houses of stock exchanges also have to be electronically linked to the depository in order to facilitate the settlement of the trades done on the stock exchanges for dematerialised shares. At present, all the major clearing corporations/houses of stock exchanges are electronically connected to NSDL.

The following stock exchanges have linked up with NSDL to facilitate trading and settlement of dematerialised securities :

- BSE Limited

- Metropolitan Stock Exchange of India Limited

- National Stock Exchange of India Limited (NSE)