Off - Market Transfers

Trading in dematerialised securities is quite similar to trading in physical securities. The major difference is that at the time of settlement, instead of delivery/receipt of securities in the physical form, the same is affected through account transfers.

Trades which are not settled through the Clearing Corporation/ Clearing House of an exchange are classified as "Off Market Trades". Delivery of securities to or from sub brokers, delivery for trade-for-trade transactions, by this definition are off-market trades.

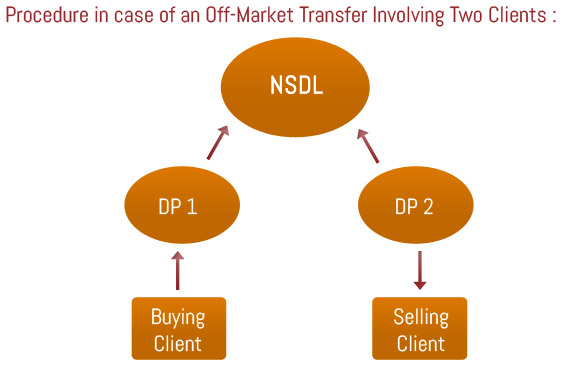

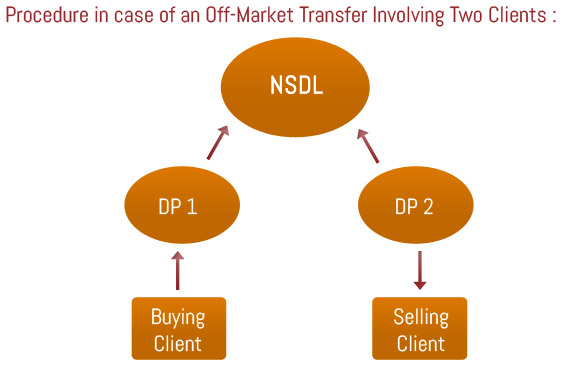

The selling client will have to give a delivery instruction to his DP to transfer securities from his depository account to the buying client's depository account. To receive securities from the selling client's depository account, the buying client must give a receipt instruction if he has not already given a standing receipt instruction to his DP.

The details in the "delivery" and "receipt" instructions must match else the transfer will not take place. The transfer will take place on the "execution date" indicated in the instructions. If the buying client has given a standing receipt instruction, this may be ignored.

The payment aspect is handled outside the NSDL environment between the selling and buying clients.

- For a transfer of securities to be effected from one account to another, details mentioned in the "delivery" and "receipt" instructions need to match. Investors need to be especially careful with respect to the "execution date" mentioned in the two forms. The transfer would be rejected if there is a mismatch in this regard even if all other details in the two forms match. In case the buyer has already given a standing receipt instruction to his DP, this may be ignored.