Home : Internet Based Facilities : STeADY

STeADY

[Securities Trading Information easy Access and DeliverY]

STEADY is a facility which enables the brokers to deliver/submit contract notes to custodians/ fund managers electronically by transmitting digitally signed trade information with encryption. It further enables fund managers to enrich the contract note and convert it into instructions for the custodian.

Introduction of on line trading and the removal of inefficiency in settlement process through the depository system are the most significant changes that have changed the face of Indian Capital Markets.

Electronic settlement facility established by NSDL helped not only in the removal of existing inefficiencies in the settlement system but also provided a basis for further reforms. On the strength of efficiency in settlement system brought about by NSDL, the seven day account period settlement was moved into T+5 settlement cycle and further to T+3. SEBI has already announced its plans for changing the settlement cycle to T+2 and further to T+1. It is necessary to automate the processing of contract notes and the communication between brokers, fund managers and custodians as a first step in the market's move to shorter settlement cycle. NSDL is the first service provider to set up such a facility.

In June 2002, SEBI set up a committee on Straight-Through Processing (STP) which studied the life cycle of a trade in order to identify the areas that involve manual intervention. It was observed that FIIs trade in India through brokers and settle the trades through their local custodians (LCs). LCs get details of trade instructions from FIIs through SWIFT messages over SWIFT network or such other service providers. However, they receive actual trade execution information from brokers in the form of physical contract notes or as soft copies (files) prepared by brokers in different formats. The LCs have to match the information received from brokers and FIIs. Further, in case of domestic Mutual Funds / Institutions, the brokers communicate the trade execution information to the fund managers and custodians, in physical contract notes and on soft copies (files). As the data is in different formats, this involves a lot of manual intervention that leads to inconvenience and possibility of errors in processing.

SEBI, therefore, suggested that as a prerequisite to implementing STP, the transfer of information from brokers to fund managers/ custodians should be standardised. In this context, NSDL decided to extend the infrastructure of SPEED-e for electronic delivery of digitally signed contract notes by brokers to custodians / fund managers in pre-defined, uniform formats. Through this system, custodians / fund managers can also confirm the contract notes to the brokers electronically or communicate rejections. The facility provides 128 bit SSL encryption for all transmission.

NSDL's initiative towards implementing STP started long back. First, NSDL introduced the Auto Delivery Out (DO) facility wherein at the time of pay-in, the securities move from the clearing account of the clearing member to the clearing house/clearing corporation automatically if the clearing member has given such an undertaking to the clearing corporation. It will be effected on the basis of instruction received from the clearing house/clearing corporation, thus saving the time and efforts of the clearing member to submit the delivery instructions to the DP.

Last year, NSDL established a common platform for its Depository Participants to enable their clients to submit the delivery instructions through Internet, thus eliminating the need to submit the instructions in paper form. This facility gives an anytime anywhere kind of freedom for the investor to submit the delivery instruction. The instruction submitted through the SPEED-e site is uploaded to NSDL depository system by the DP through their system without modifying the instruction.

NSDL has now developed the facility called STEADY for transmission of digitally signed electronic contract notes between brokers, fund managers and custodians.

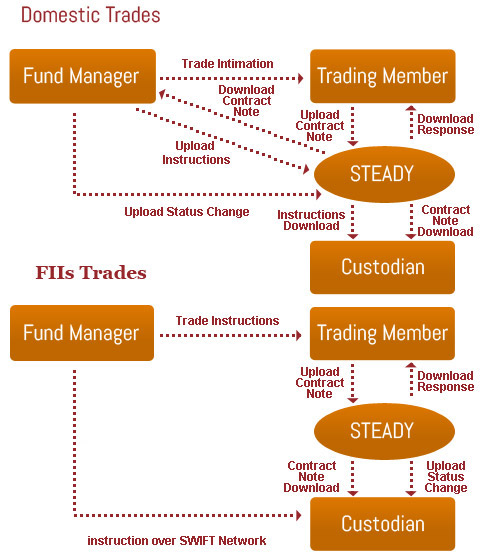

STEADY will enable electronic communication between brokers, custodians and fund managers in respect of FII and domestic trades. In order to use the STEADY facility, brokers, custodians and fund managers will have to access 'STEADY' with smart card, bearing digital signature certificate issued by licensed Certifying Authority (CA), approved by NSDL. Further all batches and uploads from brokers / custodians / fund managers will be digitally signed by the respective users and will be accepted by STEADY only after it successfully verifies the digital signature. All downloads obtained by brokers / custodians / fund managers will also bear the digital signature of STEADY site.

STEADY can be used for FII Trades and Domestic Institutional Trades

The security features are listed in the table given below :

| Features | Remarks |

| HARDWARE | |

| Redundancy | Adequate redundancy is built to prevent single point of failure |

| Load Director | Manages high User traffic |

| Smart-Card | Hardware token for strong authentication (what you know and what you have). Also, microprocessor based smart card ensures Private & Public key generation in accordance with the standards specified by Controller of certificate Authority (CCA) appointed by GOI under the provisions of IT Act 2000. The public key can be exported for certification requests whereas the private key never leaves the smart card & one can never gain access to private key unless PIN is compromised. |

| PIN pad entry | Eliminates risk of entry strokes being recorded in case of keyboard entry. Also, after 5 wrong PIN entries (PIN guessing attempts) the smart card gets locked. |

| SOFTWARE | |

| Digital Signature Certificate (embedded in Smart-Card) | Authenticates User to STEADY |

| Each activity signed separately | STEADY enforces user to affix digital signature for each and every upload, by asking the user to enter PIN on the PIN PAD every time the upload activity is undertaken. Thus even after the initial log-in, if the user is away from his/her computer without logging out for a while, some other entity cannot submit signed transactions. |

| Audit Trails | Records trail of all data captured and changed for future use |

| Last Visit Notification | Informs User about the last access (date-time) to STEADY |

| NETWORK | |

| 128 Bit encryption | All communication between STEADY and the user's computer is encrypted during transmission. |

| SSL Server Certificate | Authenticates STEADY to Users. Provides a secure tunnel for data transfer in open Internet Network. |

| Firewall | High-end firewall - prevents unauthorised access to the infrastructure. Curtails the possibility of attacks leading to disruption of services. |

File uploaded by users and downloaded from ECN will be digitally signed using valid digital signature.